Some say that ‘tax and death’ are inevitable…. As a good and responsible citizen, it is our bounden duty to pay our taxes promptly….there are direct and indirect taxes and for those of us – whose life entirely dwells on going to work, looking eagerly for the salary day, overspending whatever is earned – in the month of March struggle for making tax savings and come July, file our tax returns without fail….

Remember 31st July is the last date to file Income tax returns !!

The Central Government has been empowered by Entry 82 of the Union List of Schedule VII of the Constitution of India to levy tax on all income other than agricultural income. The Income Tax Law comprises The Income Tax Act 1961, Income Tax Rules 1962, Notifications and Circulars issued by Central Board of Direct Taxes (CBDT), Annual Finance Acts and Judicial pronouncements by Supreme Court and High Courts. The Government of India imposes an income tax on taxable income of all persons including individuals, Hindu Undivided Families (HUFs), companies, firms, association of persons, body of individuals, local authority and any other artificial judicial person. The CBDT is a part of Department of Revenue in the Ministry of Finance.

Sure you have received the form 16 – the essential document issued by Employer detailing salary, tax incidence and the amount of tax deducted from your salary at source. Every Indian citizen aged below 60 years is liable to pay income tax if their income exceeds Rs 2.5 lakhs.

To put it simply – every one with assessable income taxable will have to file their return - till a few years ago, the process was so cumbersome for common man and nearer the deadline there would be long winding queues at Aayakar bhavan for filing tax returns. Those having to pay advance tax / self-assessment tax too found it too cumbersome, having to go to designated branches and having to stand in queue for long. Then after filing the assessee had to submit the verification of the return from ITR-V for acknowledgement after signature to Central Processing Centre.

In the past, the special counters operated from IT Offices in Chennai, Mumbai and Delhi…. But don’t leave it until the proverbial 11th hour and rush for paying it on the last day. Gone are those days in modern digital India.

Now we are able to file returns electronically uploading all relevant documents – anyway, every transaction of ours is available in form 26AS. When you file your returns electronically, you would immediately get a confirmatory mail from the Income Tax department at your registered mail id. You are required to verify, print and sign the acknowledgement [ITR-V] and send it by Ordinary Post Or Speed Post or again upload electronically. .

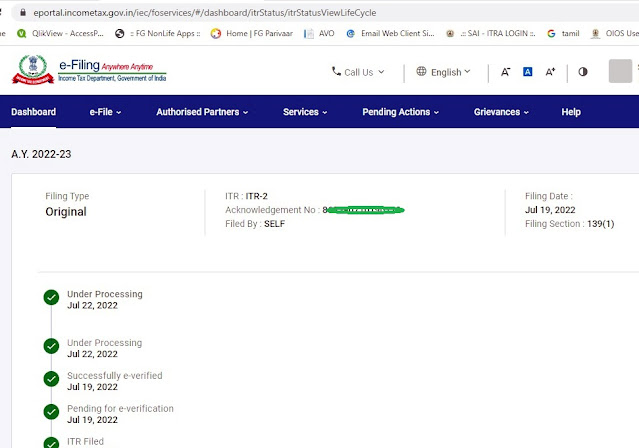

To my pleasant surprise – I

filed my returns through Auditor on 19.7.2022 and today as I got up found SMS

and email message that my returns has

been processed and refund approved. So fast.

Appreciate the good network,

pleasant experience and the speed of processing by the IT Dept and thank my

auditors M/s Devan & Co .. My

Digital India is shining ! – pic at the start – Up above the World so high,

like a diamond in the sky !!

Tailpiece: Only for the

salaried income, who are overtly worried about their income and the taxes

deducted. Indian Express a few years back reported that the CBDT has

launched an inquiry into a contentious income-tax order which dismissed a tax

demand of Rs 980 crore on jailed Haryana politician Gopal Goyal Kanda and his

business ventures, including the MDLR Group. The inquiry was also expected to

look into the sequence of events leading to the tax demand being dismissed as

it was categorised as "collectable" in February 2010, shifted to the

"difficult-to-recover" category a month later before being completely

dismissed in March 2012.

22.7.2022.

No comments:

Post a Comment