Have you heard of the term “Cash on the Nail” ? It means payment made immediately (everyone would love to have that). There is some reference to the old four pillars in Bristol of mid 16th century which initiated reference to the term ‘on the nail’ stating that business deals were sealed on these pillars.

Do you what Vortex is ? it is a spinning often turbulent flow of fluid. A spiral motion with closed streamline is vortex flow. The speed ad rate of rotation of the fluid in a free vortex are greatest at the centre an decrease progressively with distance from the centre. Have you read in recent times about an Indian company called ‘Vortex’ ?

Recently 31 visionary companies were recognized as Technology Pioneers 2011 by the World Economic Forum. WEF commended that these companies are Technology Pioneers whose business models will have a durable and valuable effect in several industries and society as a whole. They are selected on a yearly basis through a rigorous process by a selection committee comprising of Experts, academicians, venture capital firms & others. Vortex is the only Indian Company in this list.

Economic Times in their seven part series on unconventional basis had Vortex on their concluding report. They have featured in the Hindu, Financial Express, Rediff Business as also in Wall Street Journal. Vortex was founded with the focus of improving the quality of life of the rural population by building technology for practical use. This company was co founded in 2001 by a Mechanical Engineer from IIT Madras – Mr L Kannan. Vortex was founded with the focus of improving the quality of life of the rural population by building technology for practical use. Their innovation in ATM technology got them there.

As trade progressed, the need for access to easy money also progressed. The plastic card brought in a new revolution in transactions and enhanced sales. At the same time, the need for access to cash without the hassle of going to the exact premises in appointed time was also felt. In 1966, a cash dispensing device was first used in Tokyo. Little facts of this equipment are available but it appears that it dispensed cash for credit card rather than access to one’s account balances. The concept of ATM (Automated teller machine) picked up much later. In india, they are housed in small fully air conditioned rooms with security mostly. In many foreign countries, one can encounter ATMs standing out in the open in malls, airports and parking lots. Without human intervention (in some way), this dispenses cash either to the ATM / debit cards (when you have sufficient balance) or to Credit cards. Of course there are associated restrictions such as withdrawal restriction of Rs.10000/- in most teller machines. In earlier days, one had to necessarily withdraw from the ATM of the same bank wherein one had an account, lest he would be charged something extra. The plastic card which accesses ATM has a magnetic strip with a unique number – authentication is provided by the customer entering a personal identification number (PIN). There have been some instances of the equipment malfunctioning, cash not being dispensed with, extra debit to one’s account and some other troubles for the unfortunate unwary individuals.

For the regular users, this facility no doubt is a boon for one has access to cash almost everywhere at any time during the day or night. Many (mis)use the credit facility and end up paying much more. In fact the system helps travellers to withdraw cash during their travel – beyond the national frontiers – in a foreign land, you can withdraw that Nation’s currency. ATMs use a complex mechanism where the cassettes are horizontal and at bottom of ATM – cash is moved from the cassette through a conveyor belt upwards to dispense cash in the denominations preset. There also is CRT monitors mostly working on touch screen mechanism. The most common problem one would face is ATMs non functioning due to non availability of power.

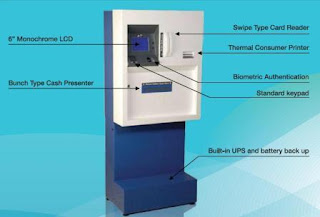

This Company has pioneered elegant and innovative cash dispensking mechanism, protected by patents and does not use any conveyor belt; the cassette is mounted vertically and in the top half of ATM. The notes traverse shorter distance and hence uses less of power. The processors involved are also lower power consuming ones, LCD consume little power and the OS is Linux. This type can easily work without any airconditioner. The lower power consumption makes it viable to cost effectively operate on solar power.

In rural India very few have formal credit mechanism and are at the mercy of local money lenders. Banks generally do not have branches in interior places and would be wary of installing ATMs due to the cost of proposition. All that is of the past…………….

Vortex Engg have installed a low cos ATM in Wai, Satara Dist in Maharashtra which would dispense money even during a power cut – an incredible achievement in rural India, thanks to the likes of L Kannan. The equipment called ‘Gramateller’ is a gift to rural India as it consumes much less of pwer, functions during power cuts, has back up power supply and has the option of running on solar power. There are some in the city who are still suspicious of ATMs and it certainly would have been a challenge to make the villagers understand that they can access their money from a lone standing machine. The Gramateller is making waves due to lesser power consumption, low cost, ability to handle wider variation in qualityof notes, biometric authorization as an alternative to PIN and the operating system of Linux. They now dream of setting up an ATM in every Indian village. Also the fact that the conventional ones would require bigger infrastructure and 3 phase whereas this one would work on single phase connection is a huge bonus. This machine reportedly costs Rs.,175000/- much lower as compared to conventional ones @ 8 – 10 lakhs. The penetration of ATMs in India is still very low and going by the spread and distance, there is great scope to prosper.

State Bank of India has reportedly placed order for a high no. of ATMs. Kannal feels fortunate to be associated with Prof. Jhunjhunwala and his associates at IIT Madras and places the rural-ATM as the outcome of that association. He says that Vortex belongs to a class of natural phenomena known in physics as 'singularities'. These are instances where conventional laws break down, infinite concentrations of energy are possible and unexpected outcomes are certain to happen.

As he points out, unfortunately, those who require huge amounts are provided loans @ lower rates but a common man would find it almost impossible to get a small loan for his enterprising needs. The first deployment of these low cost ATM was for disbursals to people under National Rural Employment Guarantee Act (NREGA). People were delighted by the transparency and accessibility of the system. The ready availability also makes them withdraw only when needed thus promoting savings. This would help large spheres of activities like pensioners receiving their monthly pensions, old parents instantaneously able to withdraw money remitted by their children working in cities etc.,

Long live the Kannans and his ilk contributing to new Indian Society.

Regards – Sampathkumar S

Hi - this is Srinivasan Sampathkumar from Triplicane. I have a passion for Marine Insurance, Cricket and Temples especially - Sri Parthasarathi swami thirukKoyil, Thiruvallikkeni. From Sept 2009, I am posting my thoughts in this blog; From July 2010, my postings on Temples & Tamil are on my other blog titled "Kairavini Karayinile " (www.tamil.sampspeak.in) Nothing gives the author more happiness than comments & feedbacks on posts ~ look forward to hearing your views !

Friday, September 17, 2010

Innovative visionary Company 2011 by World Economic Forum – Vortex Engineering.

Labels:

Nation,

Technology

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment